Courts rule Chapter 13 filers must amend schedules to show new property

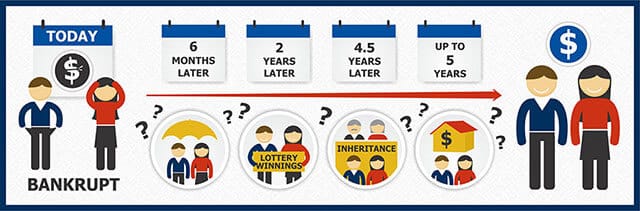

Chapter 13 bankruptcy cases can last for up to five years, and a lot can change in a person’s life during that time. In some cases, people who have filed bankruptcy may acquire new assets such as an inheritance, life insurance proceeds, lottery winnings or other property worth money. There has been a split among courts whether those who have filed Chapter 13 need to amend the schedules of their repayment plans to reflect the new assets when the filers receive new property after the initial filing, as the bankruptcy code only explicitly requires filers to report assets that filers are eligible to obtain within 180 days of filing. However, two court opinions issued in late 2013 have clarified that people need to amend their Chapter 13 schedules when they receive a windfall, no matter how long after they have filed.

Inheritance after filing Chapter 13

On October 28, 2013, an appellate court issued an opinion in Carroll v. Logan, a case dealing with whether a Chapter 13 bankruptcy filer’s inheritance was part of the bankruptcy estate. A couple filed for Chapter 13 bankruptcy in 2009, and approximately three years later they informed the court that they would receive $100,000 from an inheritance. The trustee moved to include the money in the bankruptcy estate so the money could go to the couple’s creditors. The couple objected, arguing that the law only required them to give the money to creditors if they had been eligible to receive it within 180 days of filing.

However, the court sided with the trustee, who argued that a different section of the bankruptcy code expands the bankruptcy estate to include any property that filers obtain for the duration of a Chapter 13 case.

Personal injury lawsuit as an asset

In October 2013 another appellate court issued a decision in Flugence v. Axis Surplus Insurance Co, a case that dealt with a person who filed Chapter 13 bankruptcy and then suffered injuries in a car accident three years after she filed. The woman sued to recover for her injuries, and the defendants in the case asked the bankruptcy court to rule that the woman was judicially estopped from pursuing her claim because she did not amend her bankruptcy schedule to include the information about the potential funds resulting from the lawsuit.

The court held that the personal injury claim was property of the bankruptcy estate, and the woman had been wrong not to inform the other parties to the bankruptcy case about her lawsuit. Therefore, she could not move forward with her claim.

Speak with an attorney

The two cases above demonstrate that issues can arise in bankruptcy cases well after the initial filing. Bankruptcy laws can be very complicated, and it is important to have the assistance of a skilled bankruptcy attorney throughout the duration of a bankruptcy case. If you have questions about bankruptcy, talk to an experienced bankruptcy lawyer who can discuss your specific situation with you.